By Srini Bangalore, Founder and Chief Client Officer

Introduction: The Moment Tariffs Reset Trade Reality

On April 4, the U.S. implemented a sweeping 10% universal tariff on all imported goods under the International Emergency Economic Powers Act (IEEPA), with exemptions only for Canada and Mexico contingent on USMCA compliance. A set of highly targeted reciprocal tariffs is scheduled to take effect on April 9, ranging from 17% to 49%, against over 20 countries, including China, the European Union, Japan, India, Vietnam, and Brazil.

From early and clear trade war signals in 2017, we now have full-blown geonationalist globalism. Tariffs are being used as a weapon for statecraft to advance national interests. This requires organizations to adapt and reshape their supply chains—strategically, decisively, and rapidly.

Why This Matters: From Cost Optimization to Geopolitical Orchestration

Until 2020, supply chains were primarily optimized around cost, and secondarily on speed and risk. Resilience was not a proactive strategy until the 2020 COVID pandemic, when it became a CEO and board-level topic. However, since 2023, too many executives have failed to focus on supply chain resilience. The current escalation is a catalyst that demands not ad hoc responses, but strategic reconfigurations.

This shift forces executives to:

Zoom Out: Geonationalist Globalism Has Arrived

CASETEAM defines Geonationalist Globalism as:

Globalization shaped by national sovereignty, economic self-interest, and state-driven trade policy—where strategic coupling and supply chain reconfiguration must prioritize resilience and efficiency. In short, it’s globalism with conditions.

We are not witnessing the demise of globalization. We are witnessing globalization on new sovereign terms.

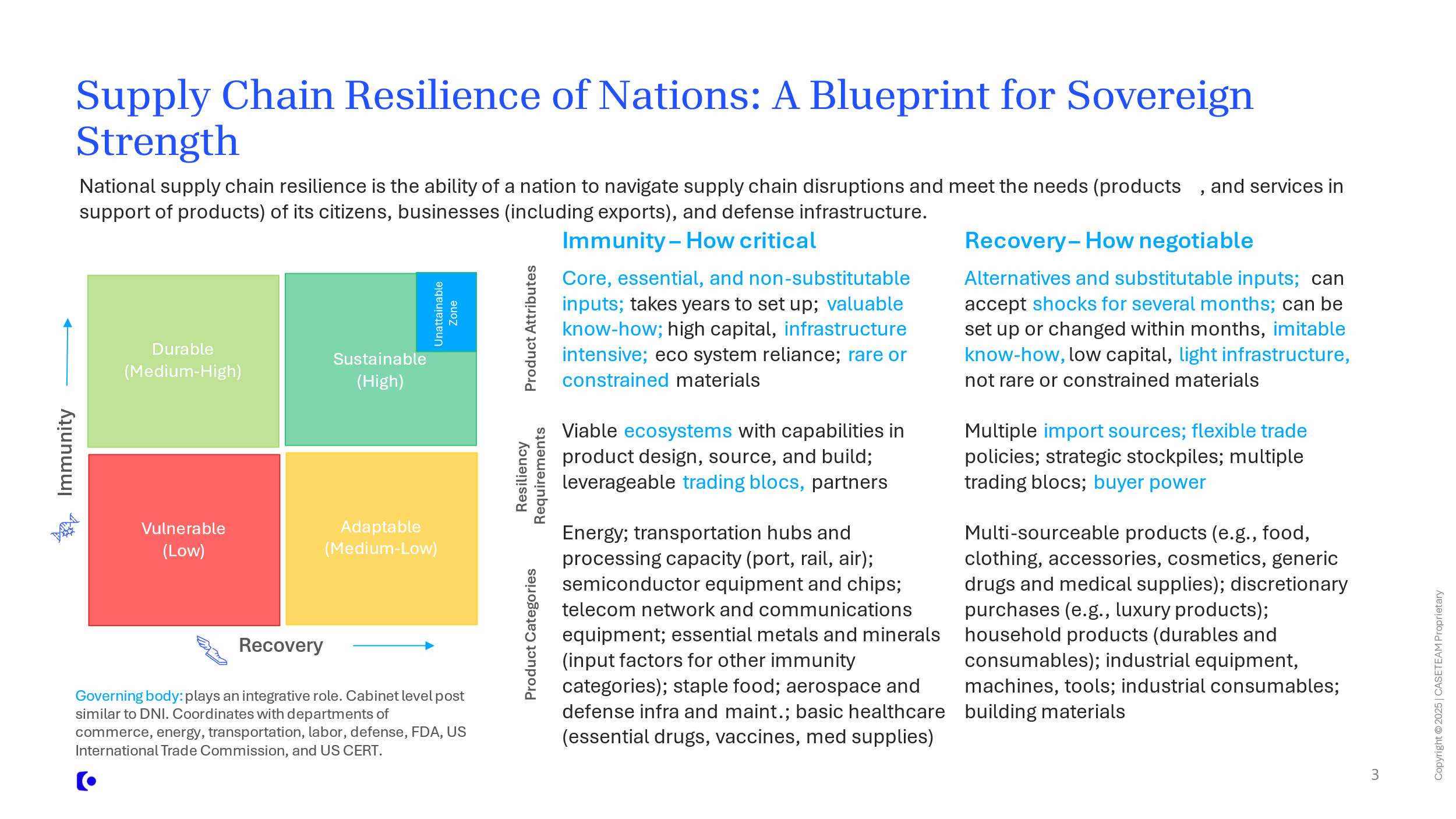

CASETEAM’s Supply Chain Resilience of Nations framework, shown in Exhibit 1, offers a blueprint for countries to assess and reshape their supply chains – ecosystems, critical inputs, suppliers, and trading partners.

Resilience Postures

Exhibit 1: Supply Chain Resilience of Nations

Strengthening national supply chain resilience is a multi-decade effort, constrained by many natural and structural factors like size, availability of valuable minerals, and current economic and military power. Countries can strengthen within a quadrant more easily than move to higher quadrants. With strategic and long-term policies, countries can make meaningful and enduring improvements to their supply chain resilience.

A country’s response to US tariffs could fall into one of four archetypes based on its resilience posture and the specifics of its trading commodities and balance with the US.

These archetypes are sector-specific and situational. One country may fall into different categories by commodity, trade balance, and counterparty (country). The combination of US actions and global responses must drive organizational supply chain resilience actions.

Zoom In: What Leaders Must Analyze and Do Now

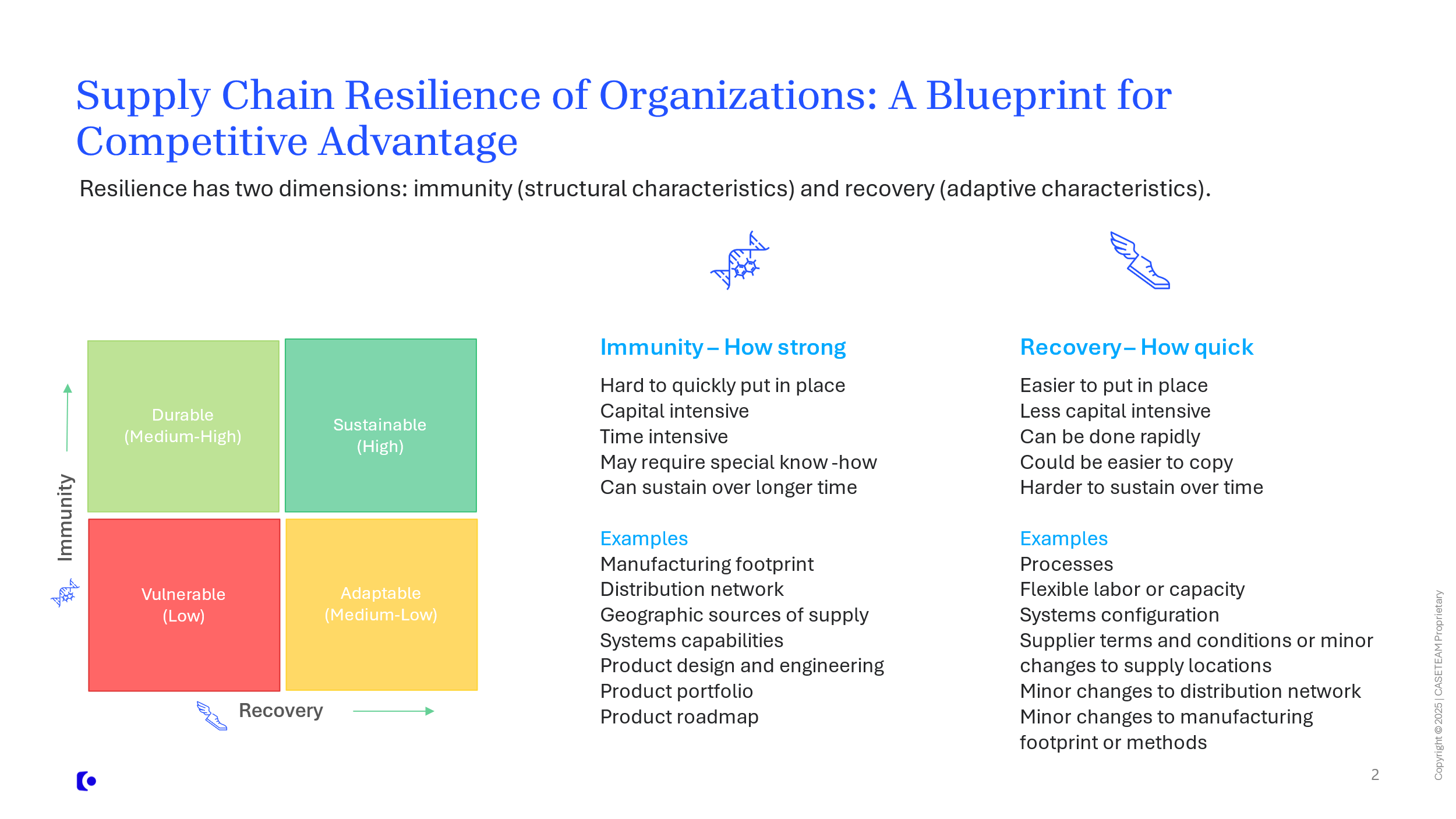

CASETEAM’s Supply Chain Resilience of Organizations framework, shown in Exhibit 2, offers a blueprint for companies to assess and reshape their supply chains – ecosystems, critical inputs, and suppliers. Strengthening supply chain resilience can be a multi-year effort. Companies can strengthen within a quadrant more easily, but must aspire to move to the durable or sustainable quadrant in the long term. With strategic and long-term policies, companies can make meaningful and enduring improvements to their supply chain resilience.

Exhibit 2: Supply Chain Resilience of Organizations

Executives must take a highly strategic approach and apply a diagnostic and intensely data-driven lens grounded in precise exposure to develop resilience strategies and actions. Actions resulting from each consideration can improve supply chain immunity or recovery capabilities. In the near term, a bias to improve “recovery” is necessary for immediate relief. In the medium to long term, “immunity” must be improved for resilience to persist. Below are considerations to frame discussions.

Companies must architect supply chains that are resilient in adapting to shifts in tariff regimes. The era of geonationalist globalism will reward “tariff-substitutable supply chains” engineered for frictional flexibility.

Call to Action: The Geonationalist Globalism Checklist

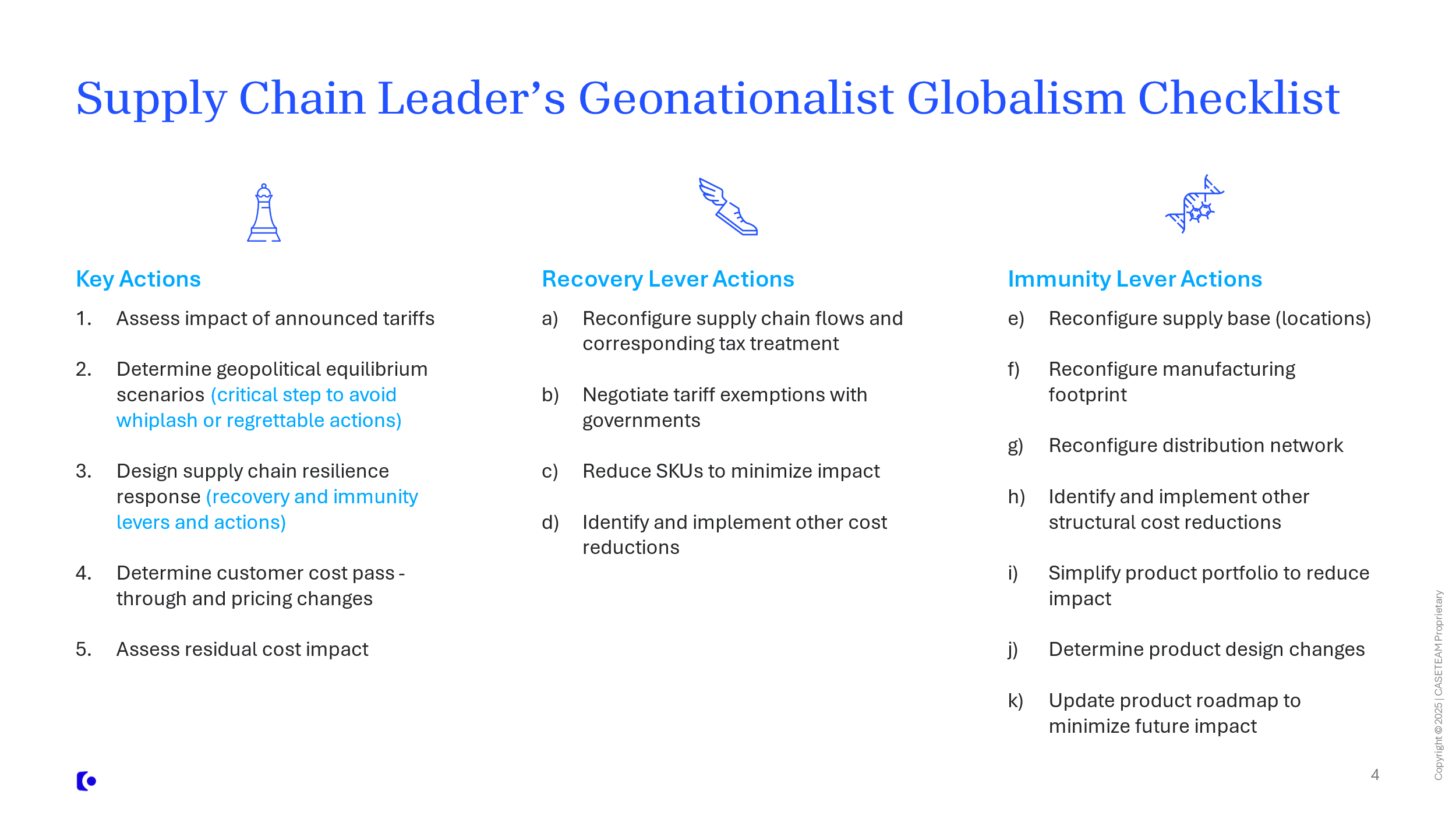

CASETEAM’s response playbook begins with what leaders must do immediately and over the medium to long term across the extended supply chain for enduring resilience and competitive advantage.

Overall approach

Exhibit 3 lists key resilience actions that improve “recovery” and “immunity”. Recovery actions are typically quicker and relatively less resource-intensive, but must also be prioritized in the near term to avoid exacerbating impact. Immunity actions typically take longer and are more resource-intensive, but many actions must be undertaken concurrently to stabilize the supply chain.

Exhibit 3: Supply Chain Leader’s Geonationalist Globalism Checklist

Supply chain leaders must now prepare for a world where tariff regimes are dynamic, persistent, and revenue-linked. The ability to neutralize, absorb, or transfer these cost shocks will be the next frontier of operational advantage.

Supply chain resilience must be architected to endure, not be episodic. Tariff is a weapon for statecraft, a tax on consumption, and a catalyst for supply chain resilience.

Geonationalist globalism is here to stay for the coming decades. CI

CASETEAM Pulse

CASETEAM PULSE articles analyze emerging and significant business events. Written to be timely, but in the “fog of uncertainty,” these articles reflect our perspectives based on information available at the time. With additional time and hindsight, some perspectives may prove to be less accurate or even inaccurate.

Related Reading: CASETEAM INSIGHTS article, “Building Resilient Supply Chains for Any World Scenario”

What the Paul Weiss Case Reminds CEOs and Boards About Stakeholder Alignment

By Srini Bangalore, Founder & Chief Client Officer

The U.S. Congress’s mandate that ByteDance divest TikTok or face a ban is a significant development in global tech regulation.

The $24.6 billion Kroger-Albertsons merger, announced in 2022, aimed to create a grocery powerhouse to compete with Walmart and Amazon. However, regulatory opposition and public backlash…

Mergers and acquisitions are among the most transformative moves a company can make to accelerate growth — but it is commonly known that 70% or more of M&A transactions fail …

In today’s highly interconnected economy, supply chain resilience is no longer just a defensive strategy…

Between the forces of genAI disrupting all industries and a change of administration in the US, there is a widespread belief that M&A activity will pick up.

By Srini Bangalore and Cate (genAlyst™)

By Srini Bangalore, Founder & Chief Client Officer | Cate, genAlyst

CASETEAM Launches as GenAI-native and Hybrid-first Management Consulting Firm, Innovating a New Model that Makes Top-tier Problem-solving Accessible to More Organizations

By Integrating GenAI with Human Ingenuity, CASETEAM Creates a New Model for Management Consulting

Q&A with Cate, genAlyst at CASETEAM

[Note: Cate is a genAI model configured for the needs of CaseTeam]

Share this Post