Mergers and acquisitions are among the most transformative moves a company can make to accelerate growth — but it is commonly known that 70% or more of M&A transactions fail …

Introduction: Why Timeline is a Critical Factor in Integration Success

Mergers and acquisitions are among the most transformative moves a company can make to accelerate growth — but it is commonly known that 70% or more of M&A transactions fail to achieve their goals. Assuming the right value thesis for an acquisition and a sound integration strategy, the integration timeline is the next critical determinant of achieving goals, particularly revenue and cost synergies. This is the focus of our article.

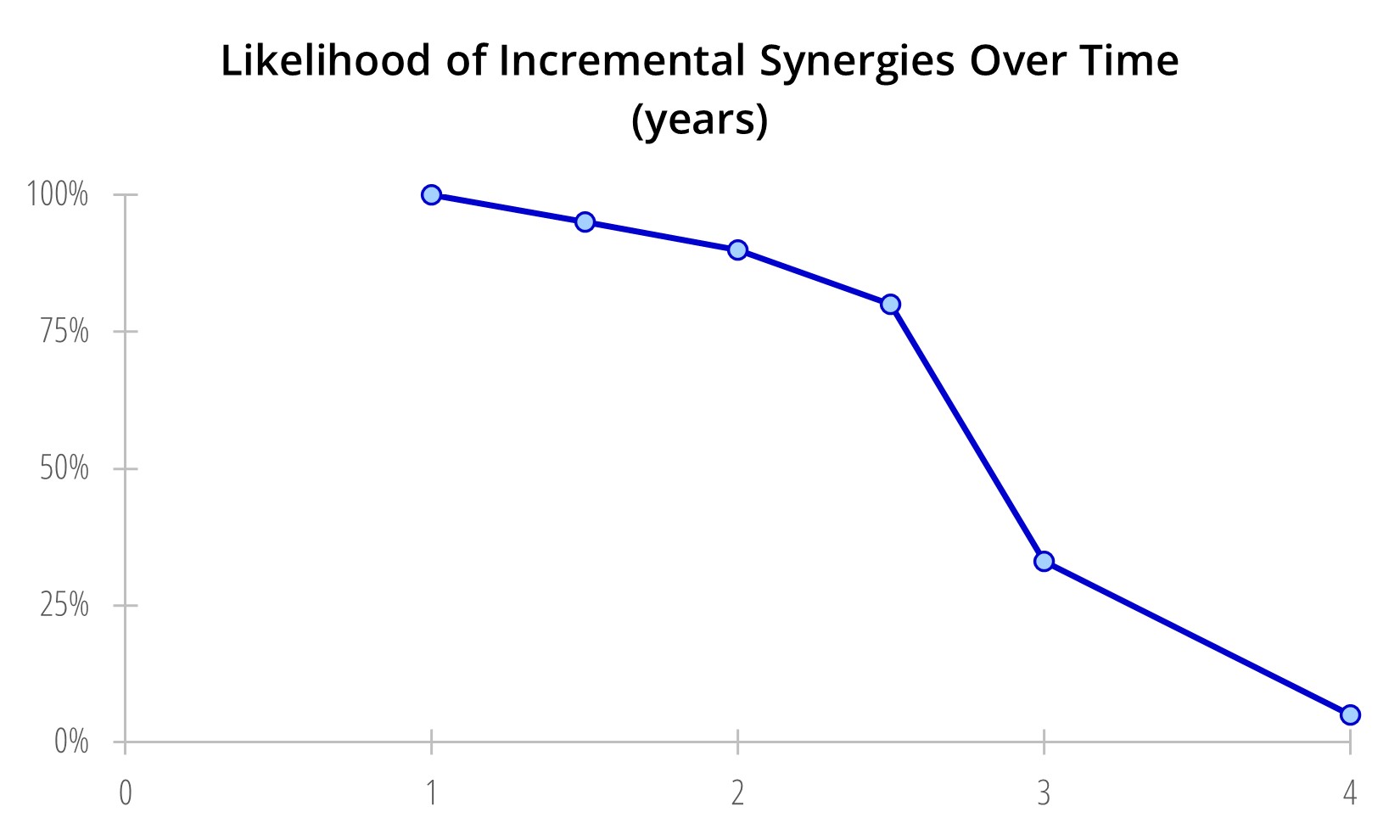

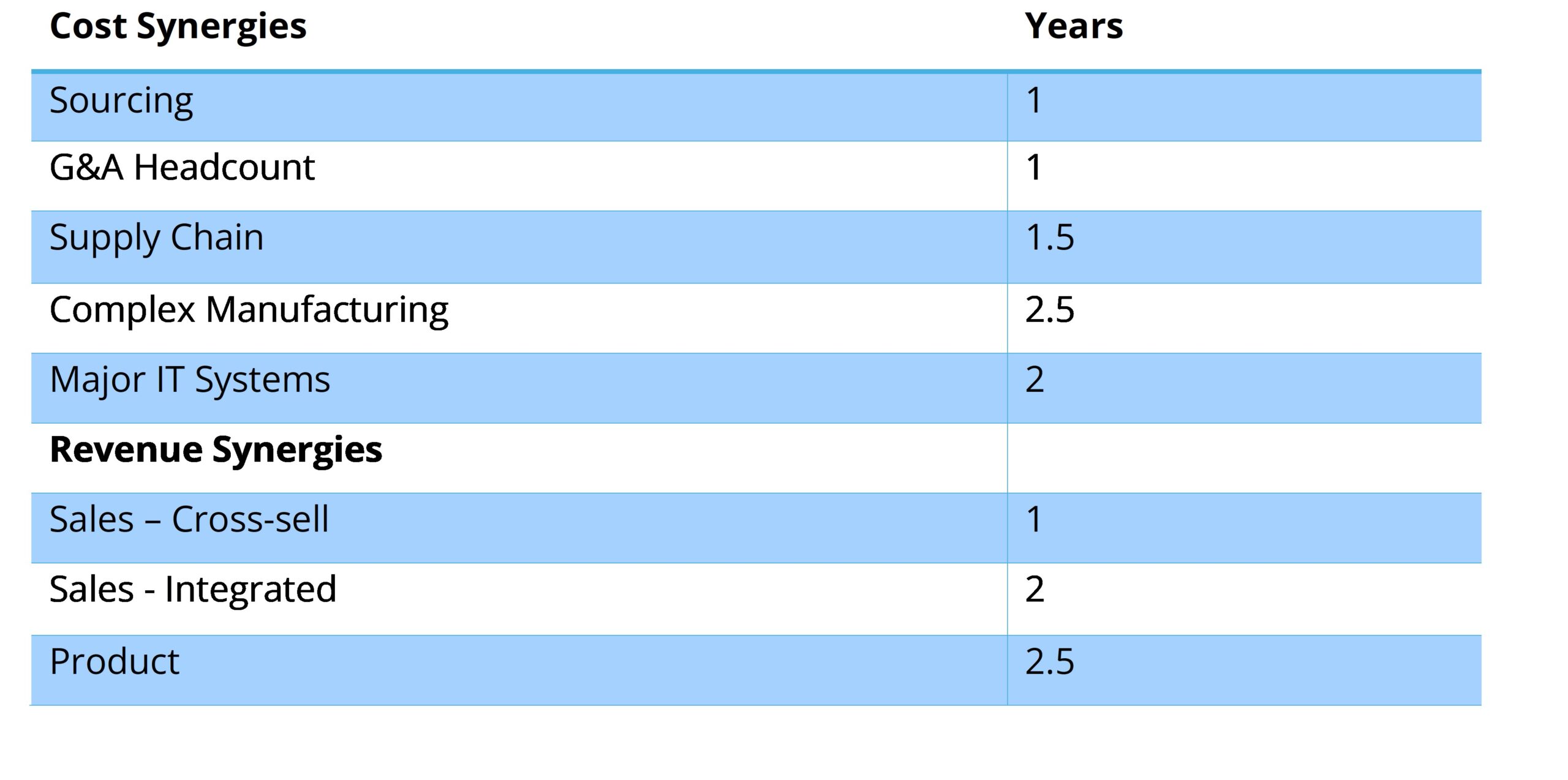

CASETEAM’s experience in M&A integrations and large-scale business transformations reveals a striking pattern: integrations that fail to achieve critical objectives within 2.5 years almost never deliver results beyond that period. This “2.5-Year Rule” is grounded in three recurring challenges: organizational fatigue, shifting management priorities, and evolving market conditions. Success requires disciplined execution, clear accountability, and a relentless focus on achieving measurable outcomes within this window.

Why This Matters: Risks of Delayed Integration

The longer an integration stretches, the greater the risk of failure. Common pitfalls include:

Our experience on several integration and transformation programs shows that companies meeting key milestones, including run-rate revenue, product, and cost synergies within 24 to 30 months, are far more likely to realize sustained value than those that execute over longer timelines. The exhibit illustrates the likelihood of achieving incremental synergies over time, with year 1 as the baseline.

Zoom Out: The Essentials of M&A Integration

Achieving success within the 2.5-year integration threshold requires companies to focus on three simple yet critical elements:

The above approach ensures your integration remains focused, efficient, and effective.

Zoom In: Overcoming Barriers to Integration Success

Case Examples: Successes Within the 2.5-Year Rule

The examples below, based on CASETEAM experience and research illustrate value created by managing integration time lines.

Software sector

A large software company on the path to diversification acquired a smaller player to expand its product offerings. In this multi-billion-dollar acquisition, the company prioritized product synergy and integrating features of the acquired products. With this as the mission, within 18 months, the acquired product features were integrated into the company’s major product platforms and drove customer value proposition. Early revenue synergy wins included joint customer solutions that underscored the value of rapid integration.

Retail distribution

A large retailer acquired a much smaller retail chain to expand its brick-and-mortar stores. There was a clear strategy to integrate the operations (e.g., logistics, procurement) and maintain the acquisition as a sub-brand. The company was able to achieve both objectives in just under two years, improving revenue, reducing distribution costs, and extending loyalty programs.

These cases highlight how time-focused integration strategies can deliver value while avoiding the risks of protracted timelines.

Case Example: Failures Within the 2.5-Year Rule

Hardware sector

In a merger of equals, teams were not able to agree on a product development philosophy to integrate product roadmaps. The impasse continued for more than six months while there was top talent attrition. Product revenue synergies were not achieved. Only partial cost synergies were achieved, mainly through talent attrition versus R&D program rationalization or product roadmap alignment.

Conclusion and Call to Action

Successful M&A integration depends on meeting critical objectives within a 2.5-year timeline. Companies planning or executing M&A integrations must assess their current integration processes, leadership, resource allocation, and methods. Are your leaders ready to deliver results within 2.5 years? Are priorities clear and achievable? If the answer to any of these questions is no it’s time to fix the issues. CI

By Srini Bangalore, Founder and Chief Client Officer

What the Paul Weiss Case Reminds CEOs and Boards About Stakeholder Alignment

By Srini Bangalore, Founder & Chief Client Officer

The U.S. Congress’s mandate that ByteDance divest TikTok or face a ban is a significant development in global tech regulation.

The $24.6 billion Kroger-Albertsons merger, announced in 2022, aimed to create a grocery powerhouse to compete with Walmart and Amazon. However, regulatory opposition and public backlash…

In today’s highly interconnected economy, supply chain resilience is no longer just a defensive strategy…

Between the forces of genAI disrupting all industries and a change of administration in the US, there is a widespread belief that M&A activity will pick up.

By Srini Bangalore and Cate (genAlyst™)

By Srini Bangalore, Founder & Chief Client Officer | Cate, genAlyst

CASETEAM Launches as GenAI-native and Hybrid-first Management Consulting Firm, Innovating a New Model that Makes Top-tier Problem-solving Accessible to More Organizations

By Integrating GenAI with Human Ingenuity, CASETEAM Creates a New Model for Management Consulting

Q&A with Cate, genAlyst at CASETEAM

[Note: Cate is a genAI model configured for the needs of CaseTeam]

Share this Post