Between the forces of genAI disrupting all industries and a change of administration in the US, there is a widespread belief that M&A activity will pick up.

With the continued momentum of genAI, paired with a more friendly regulatory environment, M&A activity can experience tailwinds in 2025 and beyond. This presents opportunities for companies to be more aggressive but requires them to be thoughtful in their M&A moves—both during diligence and integration or carve-out. To help decision-makers prioritize their M&A strategies and tactics, we explore four drivers (market, product, capability, regulatory) that influence the archetype of technology (emerging, stable, or mature) deals.

Why This Matters

The global tech M&A landscape has continuously evolved:

Understanding the drivers of the deal and the resulting archetypes enables organizations to identify the opportunities most aligned with their strategic objectives and be a “prepared buyer or seller” and eventually execute a successful deal.

Zoom Out: The Four Drivers

Starting with the business strategy and specific objectives helps determine how best to take advantage of the drivers that impact the nature and success of an M&A deal. For instance, do you want to expand into a new market? Acquire new technology to leapfrog a competitor? Do you want to shed a declining business? Each of the strategies directs you to evaluate potential deal archetypes, e.g., a strategic market acquisition in a new country, a tech tuck-in, or a non-core divestiture.

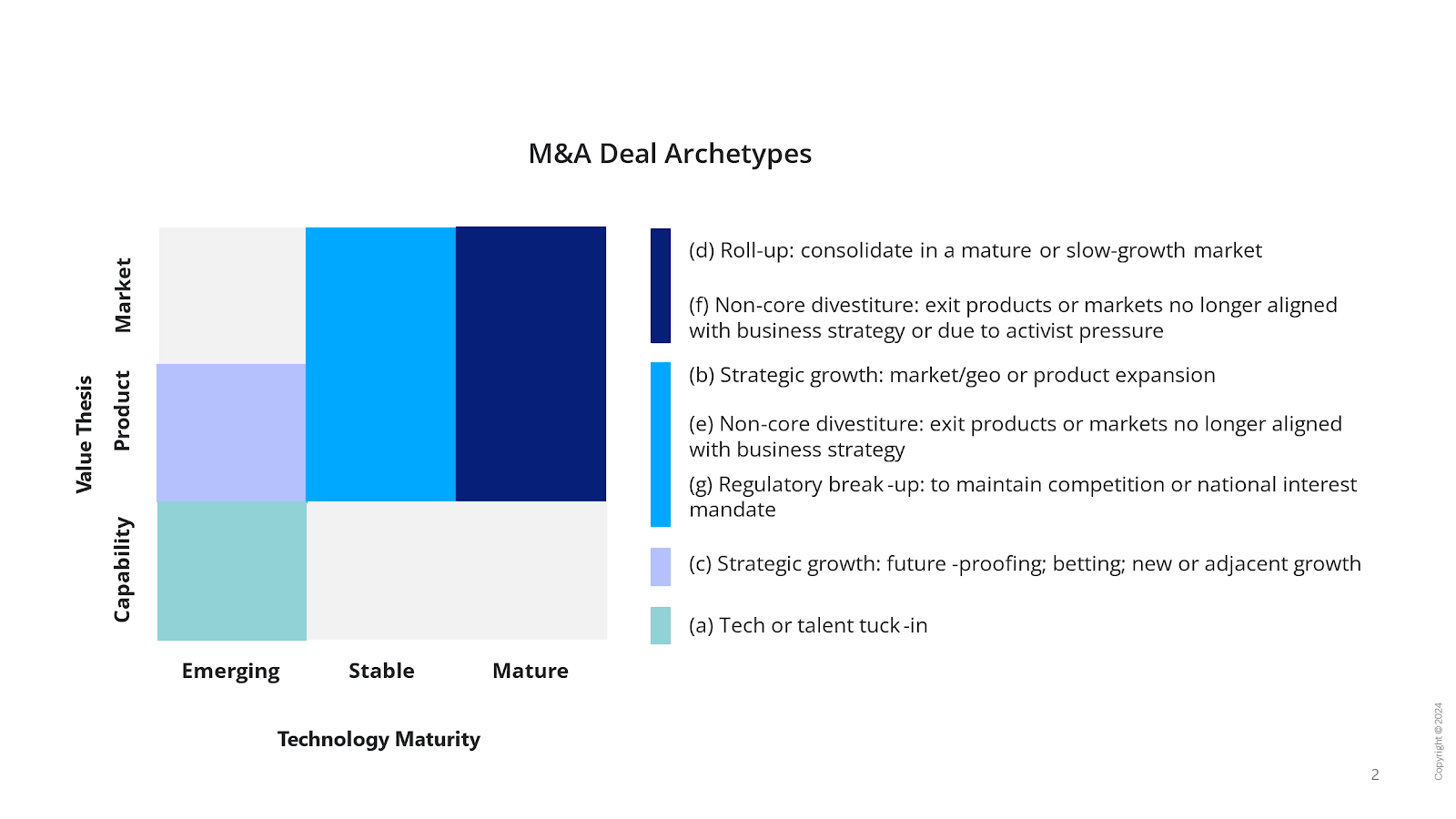

Tech M&A strategies are influenced by four drivers, with seven archetypes, (a) through (g), below:

1. Capability-Focused (Emerging Technology)

(a) Tech and Talent Tuck-ins: Acquisitions of niche technologies or teams to gain technical expertise or innovation (e.g., a mobile devices company acquiring hinge technology for foldable devices).

2. Product-Focused (Emerging to Mature Technology)

(b) Strategic Growth (Market/Geo, Business Model Evolution): Focused on expanding market reach or evolving business models, such as moving into subscription-based services (e.g., gaming company acquiring cloud gaming software to expand SaaS).

(c) Strategic Growth (cross-industry): Cross-industry technology acquisitions, such as healthcare firms acquiring telehealth platforms to enhance service offerings.

3. Market-Focused (Stable to Mature Technology)

(d) Mature Consolidation: Consolidating underperforming or saturated markets (e.g., printer companies merging to streamline R&D and production operations).

(e) Non-Core Divestitures: Companies spinning off non-core assets, such as a legacy software product, to focus on cloud offerings.

4. External Pressures (Mature Tech)

(f) Activist Carve-Outs: Divisions spun off under investor pressure or as part of a strategic separation to unlock shareholder value (e.g., tech company separating a slow-growth business unit or to renew focus on each business unit).

(g) Regulatory Break-Ups: Mandated divestitures or concessions driven by regulatory pressures (e.g., platform companies exiting specific markets or products to comply with antitrust laws or foreign investment requirements).

Zoom In: Key Challenges and Considerations

While the four drivers offer strategic guidance to craft a deal and the seven archetypes offer a roadmap for tactical M&A execution, below are broad challenges to be prepared for:

Call to Action: Evaluate Your Moves

To maximize value from tech M&A in 2025 and beyond, Tech companies must:

M&A is no longer a growth strategy just for medium to large companies. It’s a choice for companies of all sizes. Going into it with eyes wide open is necessary to improve the odds of success and being in the ~30% of companies that create value from M&A. CI

By Srini Bangalore, Founder and Chief Client Officer

What the Paul Weiss Case Reminds CEOs and Boards About Stakeholder Alignment

By Srini Bangalore, Founder & Chief Client Officer

The U.S. Congress’s mandate that ByteDance divest TikTok or face a ban is a significant development in global tech regulation.

The $24.6 billion Kroger-Albertsons merger, announced in 2022, aimed to create a grocery powerhouse to compete with Walmart and Amazon. However, regulatory opposition and public backlash…

Mergers and acquisitions are among the most transformative moves a company can make to accelerate growth — but it is commonly known that 70% or more of M&A transactions fail …

In today’s highly interconnected economy, supply chain resilience is no longer just a defensive strategy…

By Srini Bangalore and Cate (genAlyst™)

By Srini Bangalore, Founder & Chief Client Officer | Cate, genAlyst

CASETEAM Launches as GenAI-native and Hybrid-first Management Consulting Firm, Innovating a New Model that Makes Top-tier Problem-solving Accessible to More Organizations

By Integrating GenAI with Human Ingenuity, CASETEAM Creates a New Model for Management Consulting

Q&A with Cate, genAlyst at CASETEAM

[Note: Cate is a genAI model configured for the needs of CaseTeam]

Share this Post